In today’s world, unexpected financial emergencies can arise at any time. Whether it’s a medical emergency, a car repair, or a sudden bill, access to fast cash can be crucial. If you need quick cash, a pawn shop loan may be an option worth considering.

Pawn shop loans, also known as collateral loans, allow you to borrow money by using valuable items such as jewelry, electronics, or musical instruments as collateral. Pawn shop loans offer several advantages over traditional loans.

- First, there’s no credit check required, which means that even if you have a poor credit score, you can still be approved for a loan.

- Second, the loan process is quick and straightforward, and you can receive cash on the same day.

- Third, you can get a loan for relatively small amounts of money, making it ideal if you only need a small sum of cash.

However, like any loan, pawn shop loans also have some downsides. The interest rates and fees charged by pawnbrokers can be high, making it expensive to borrow. Additionally, if you fail to repay the loan within the agreed-upon time frame, the pawnbroker has the right to sell your item to recoup their losses.

If you’re considering a pawn shop loan, it’s important to understand the process and risks involved. In this article, we’ll look at how pawn shop loans work, the pros and cons of this type of borrowing, and tips for getting the best deal on a pawn shop loan.

By the end of this article, you’ll better understand whether a pawn shop loan is the right option for your financial needs.

How Pawn Shop Loans Work

To get a pawn shop loan, you bring in an item of value, such as jewelry, electronics, or musical instruments, to the pawnbroker. The pawnbroker will appraise the item and offer you a loan based on its value. The loan amount is usually a percentage of the appraised value, and the pawnbroker will hold onto the item as collateral until the loan is repaid.

The repayment terms vary by state and pawn shop, but typically, you have 30 to 90 days to repay the loan plus interest and fees. If you can’t repay the loan, the pawnbroker will keep the item and sell it to recoup their losses.

The Pros and Cons of Pawn Shop Loans

Pawn shop loans have several advantages over traditional loans. First, there’s no credit check required, so you can get a loan even if you have bad credit. Second, the process is quick and easy, and you can walk out with cash in hand. Third, you can get a loan for a relatively small amount of money, which is helpful if you only need a small amount of cash.

However, pawn shop loans also have some disadvantages. Interest rates and fees can be high, making them expensive borrowing. You also risk losing your item if you can’t repay the loan, so you should only pawn items that you’re willing to part with.

Tips for Getting the Best Deal on a Pawn Shop Loan

If you’re considering a pawn shop Smyrna, there are several tips that can help you get the best deal possible. Here are some tips to keep in mind:

Research several pawn shops: Don’t just go to the first pawn shop you see. Do your research and compare rates and fees at different pawn shops to find the best deal.

Negotiate the interest rate and fees: Many pawnbrokers are willing to negotiate the interest rate and fees, so ask if there’s room for negotiation.

Know the value of your item: Before taking out a pawn shop loan, be sure to know the value of the item you’re using as collateral. This can help you negotiate a better deal and avoid being lowballed by the pawnbroker.

Read the terms and conditions of the loan: Be sure to read the terms and conditions carefully, including the interest rate, fees, and repayment period. Ask questions if anything is unclear.

Consider a shorter repayment period: While it may be tempting to extend the loan repayment period, higher interest rates and fees can be generated. Consider repaying the loan as soon as possible to minimize costs.

Don’t borrow more than you need: Only borrow the amount of money you need, as borrowing more can lead to higher interest rates and fees.

Be prepared to walk away: If you’re not comfortable with the terms and conditions of the loan, be prepared to walk away and find another pawn shop or alternative borrowing option.

A pawn shop loan can be a fast and convenient way to get fast cash pawn when you’re in a bind. However, it’s important to understand the risks and fees involved, and only pawn items that you’re willing to part with. With some research and negotiation, you can get the best deal on a pawn shop loan and get the cash you need quickly.

If you need fast cash and have valuable items that you can use as collateral, a pawn shop loan may be a viable option. While interest rates and fees can be high, it’s important to weigh the benefits of quick cash and no credit check against the risks of potentially losing your valuable item if you can’t repay the loan.

Before taking out a pawn shop loan, be sure to research the pawn shop and read the terms and conditions of the loan carefully. Consider negotiating the interest rate and fees to get the best deal possible.

If you decide to take out a pawn shop loan, be sure to repay the loan on time to avoid losing your valuable item. If you’re unable to repay the loan, consider negotiating with the pawnbroker to extend the loan or come up with a repayment plan.

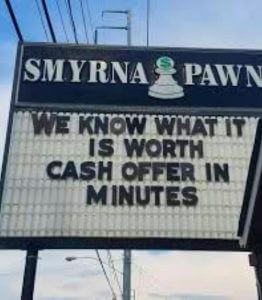

Smyrna Pawn

Welcome to Smyrna Pawn Brokers, a reputable and long-standing family-owned pawn shop in Cobb County, Georgia. With a rich history dating back to 1977, we have been committed to delivering exceptional services to our esteemed customers.

Situated in Smyrna, Ga, just 10 miles northwest of Atlanta, we take immense pride in serving the local community and beyond for over four decades. Our dedication to ensuring customer satisfaction shines through our personalized approach to service. When you step into our establishment, you are not simply a customer, but an integral part of our extended family.

At Smyrna Pawn Shop, we recognize that each customer has distinct needs and circumstances. Our team of seasoned professionals is always ready to lend an ear, understand your concerns, and collaborate with you to discover the optimal solution. Whether you require a short-term loan, wish to sell or pawn your valuable items, or seek top-notch merchandise at affordable prices, we are here to assist you.

We cordially invite you to visit our store and experience the distinctive Smyrna Pawn Brokers experience firsthand. Our friendly staff is delighted to address any queries you may have and guide you in finding the products or services that best cater to your requirements. Thank you for selecting Smyrna Pawn Brokers as your go-to destination for all your pawn shop necessities.

Our pawn shop is the best pawn shop in our locality, offering the most excellent service in the area. Check out our website and contact us.